Note: this client note has been edited since it was originally sent to our clients in 2018, in order to clarify language related to our dynamic derivatives portfolios

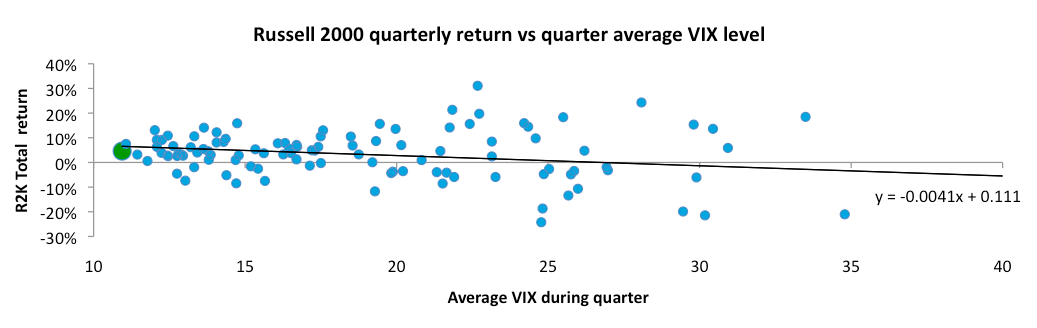

Our derivative market stress indicator is designed to bullishly position our dynamic derivatives portfolios only when conditions are consistent with the likelihood of positive returns and a reduced probability of steep losses. In general it has us bullish (that is, shorting volatility) when equity market volatility is relatively high but declining, and bearish when equity markets are abnormally calm or becoming more volatile.

The first quarter of 2018 brought a sharp transition from a very low volatility equity market regime to one of above average volatility. To us it was a transition from a regime in which it was difficult to profit in derivatives without taking undue risk, to one in which we expect shorting volatility to be profitable again with an acceptable risk profile.

Our system is designed to avoid much of the steep potential short volatility losses during such a transition. In the first quarter our Titan strategy avoided 84% of the losses incurred by the VIX Short Term Futures Inverse Index. The index suffered its worst losses in the quarter on three separates instances in which the VIX index jumped by more than 25% in one day; our derivative market stress indicator had our client assets protected in cash for all three.

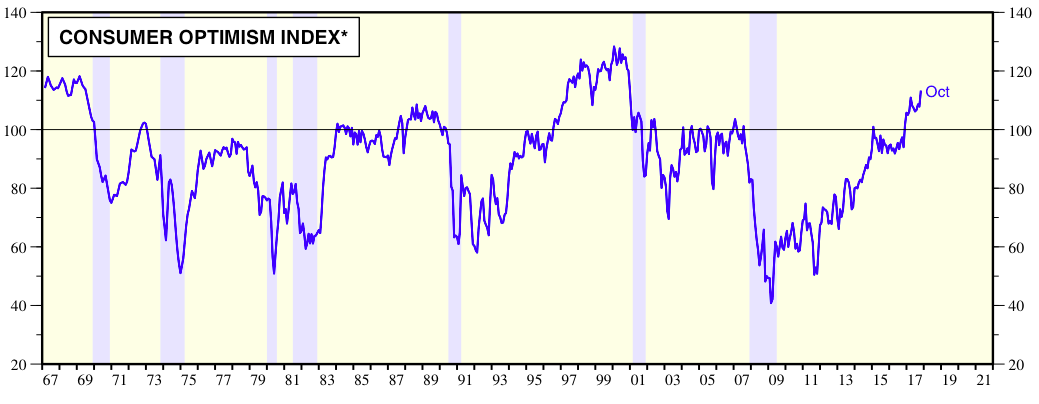

Our previous Titan client note was sent out on February 1st of this year. Coincidentally, the Titan system had just moved our clients’ assets to cash on January 29th. The note reflected on the eerie calm prevailing in equity markets. The very next day after we sent that note, Jerome Powell arrived as the new Federal Reserve chairman, and the Bureau of Labor Statistics released an unexpectedly strong employment & wage report.

Those two relatively innocuous items combined to make it evident the Federal Reserve would likely raise interest rates 4 times in 2018, setting in motion a rapid equity market selloff and accompanying volatility spike. On Monday February 5th the S&P 500 index declined 4% from its Friday close, its largest close-to-close decline in over 6 years. The VIX index (recall that the VIX is essentially a normalized price for equity downside risk insurance) increased by 116%, its largest one-day percentage change ever.

The transition from low volatility to high volatility, which commenced January 26th and was complete by February 8th after delivering a cumulative 10.1% S&P decline, was remarkable partly because it came so quickly following the 7.4% S&P sprint higher in January. Over the last ninety years, equity price momentum has never exhibited such dramatic short-term deterioration. One World War, one Great Depression, thirteen other official recessions and various financial panics all did not generate the reversal in equity price action observed in the first 6 weeks of 2018.

Realized volatility remained elevated for the remainder of the quarter, with the February-March period registering annualized realized volatility of approximately 24%, double the non-recessionary volatility since 1990, and more in line with that observed in the recessions of 2001 and 2008-2009. A return to elevated levels of equity market volatility was to be expected, and is in fact necessary for our dynamic derivatives portfolios to have meaningful opportunity for profit in the future. So we welcome the first quarter’s reset to a higher, more typical level of volatility.