There are many ways in which the second quarter of 2017 was unusual for U.S equity markets, especially with regards to market volatility.

Recall that the VIX index reflects a normalized price being paid by investors for protection against downside movements in the S&P 500 index. Lower readings of the VIX imply relatively low demand by investors for this protection. VIX closing levels below 10.0 have been exceedingly rare: over a 27 year period (January 1, 1990 through April 30, 2017) there were only ten days on which VIX closed below 10.0, the most recent being in January of 2007, well before the Global Financial Crisis erupted.

Then, in May and June of 2017, the VIX index closed below 10.0 on seven additional trading days and averaged 10.69, the lowest 2-month average level in its 27-year history. Equity market behavior has for now justified such low demand for protection: The S&P 500’s peak-to-trough range (one measure of realized volatility) in the month of June was the narrowest it has been since the 1960s.

Source: Yardeni.com

One possible explanation for such investor confidence toward U.S. equities is that the S&P 500 appears to have genuinely emerged from its earnings recession of 2015 and 2016. The above chart shows that operating profit per share, and management expectations for earnings per share, declined significantly in 2015 & 16. That trend has now reversed, and if the current profit cycle follows the pattern of past cycles, there is the potential for several more quarters of S&P 500 profit growth ahead.

Source: National Federation of Independent Business (NFIB)

The National Federation of Independent Business, a trade organization for small U.S. businesses, publishes the above small business optimism diffusion index. It combines quantitative measures, such as changes in small business inventories and job openings, with responses to survey questions such as expectations for future revenue growth. The index remains near the historically high levels it reached immediately after the presidential election, signaling a sustained level of economic optimism not present in U.S. small businesses for over a decade.

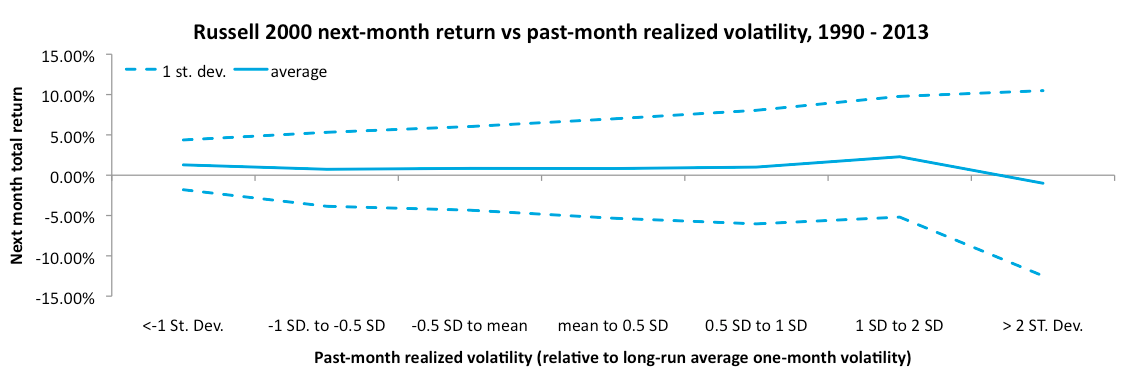

Such optimism, low equity volatility, and low fear of volatility, might be taken as a signal of investor complacency and an early-warning sign of a market top. A risk-averse investor might seek to take profits in such conditions. Our analyses of the historical VIX index and equity market data going back to 1990 have shown us that the best approach to such low volatility regimes is to maintain exposure to equities. Our indicator system has done just that in 2017, driving steady positive returns for our strategies and for our clients.